Will TACO save the US economy?

Consumer vibes stop sliding thanks to TACO = Trump Always Chickens Out.

Source: twitter.com

Quotable presidential quotes

Megan Casella (CNBC): “Mr. President, Wall Street analysts [Robert Armstrong, Financial Times] have coined a new term called the TACO trade. They're saying Trump Always Chickens Out on your tariff threats, and that's why markets are higher this week. What's your response to that?”

President Donald Trump: “we have $14 trillion now invested, committed to investing when Biden didn't have practically anything. Biden -- this country was dying. You know, we have the hottest country anywhere in the world. Six months ago this country was stone cold dead. We had a dead country. We had a country, people didn't think it was going to survive, and you ask a nasty question like that… don't ever say what you said. That's a nasty question.” (2025-5-28)

President Harry Truman: “If you can't stand the heat, get out of the kitchen.” channeling his friend, Missouri Judge Eugene Purcell

Hot takes (some facts, some opinions)

The final Index of Consumer Sentiment (ICS) reading for May confirms that the US economy is in vibecession with ICS down -26% since January.

The good news: consumer vibes stopped falling after 4 down months.

Over the rest of the year, will consumer vibes follow the stock market’s lead and turn back up because of TACO (= Trump Always Chickens Out)?

After a -26% fall in consumer vibes, it may be too late to avoid recession.

Trump’s report of the economy’s death under Biden was greatly exaggerated.

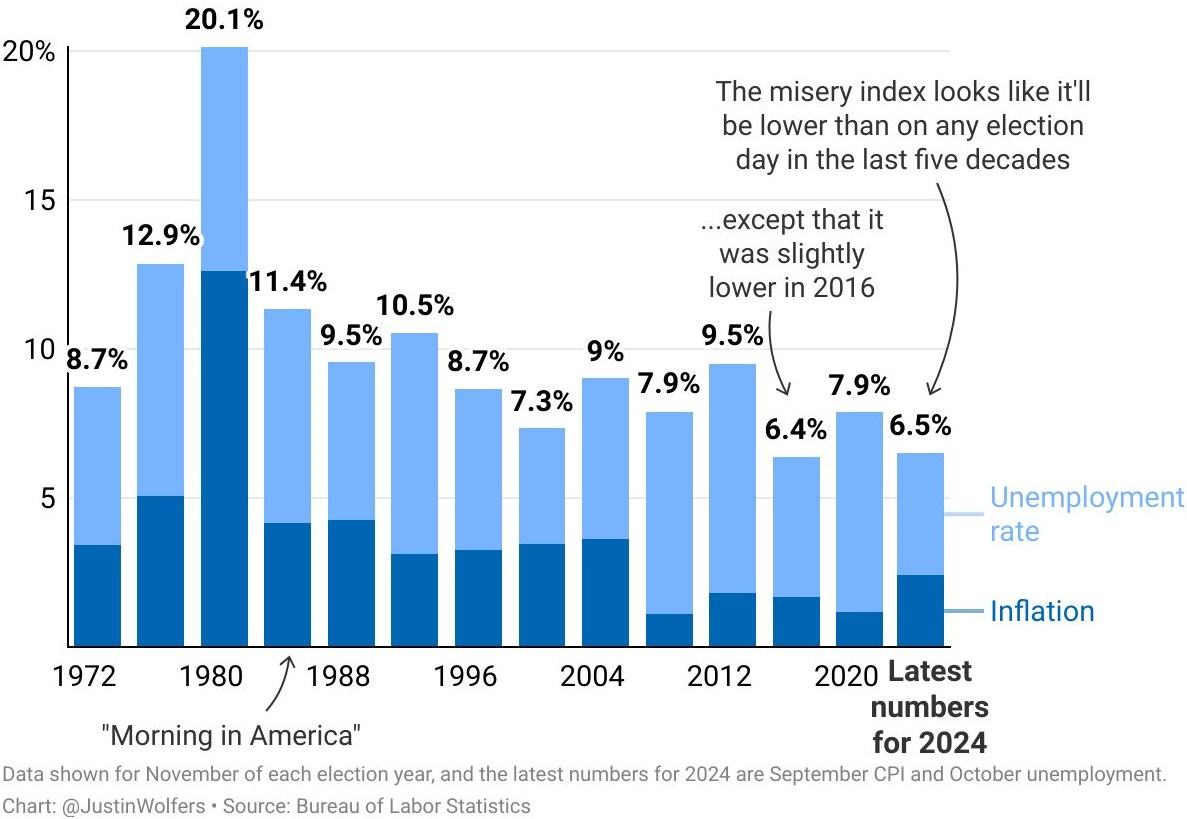

The misery index (= inflation + unemployment rates) in January when Biden handed office to Trump was better than for any incoming president since 1953.

Trump wasn’t deliberately lying about Biden’s “stone cold dead” economy. Trump doesn’t know enough about the economy to be accused of consciously lying.

TACO puts floor under consumer vibes

There was no change in consumer vibes from April to May. The report by the University of Michigan marked the first month in 2025 that the Index of Consumer Sentiment (ICS) did NOT fall.

The commentary by Surveys of Consumers Director Joanne Hsu is consistent with the TACO take on the Trump economy.

“Consumer sentiment … had ebbed at the preliminary reading for May but turned a corner in the latter half of the month following the temporary pause on some tariffs on China goods. Expected business conditions improved after mid-month, likely a consequence of the trade policy announcement… Given that consumers generally expect tariffs to pass through to consumer prices, it is no surprise that trade policy has influenced consumers’ views of the economy.”

In other words, the decisive factor lifting consumer vibes over the 2nd half of this month was Trump chickening out on his most extreme tariff threat. On May 12th, the US announced a cut in the tariff on imports from China to 30% from 145%.

Too late for TACO to prevent vibecession

To assess whether the US economy has fallen into what Kyla Scanlon called:

“Vibecession - a period of temporary vibe decline where economic data … are relatively okayish.” (June 2022)

I apply what I call the Scanlon-Sayeed rule defining a vibecession as at least a -20% fall in ICS measured as 3-month average values. I call it the Scanlon-Sayeed rule on the grounds that:

Scanlon invented the vibecession concept.

I provided a quantitative threshold.

Consumer vibes are down -26% since the recent peak in January 2025 with ICS measured using 3-month averages to smooth out any spurious “blips” in the monthly surveys. The US economy has definitely entered a vibecession at the very least.

Can TACO prevent recession?

The question now is whether the US economy remains “relatively okayish”, as Kyla Scanlon put it in her qualitative definition of “vibecession” in 2022.

If the National Bureau of Economic Research subsequently states that an economic recession started within 12 months after ICS hits bottom, my vibecession call for 2025 will be superseded by recession. The -26% fall in consumer vibes so far this year does not tell us definitively whether the US economy is falling into recession. After all, ICS fell even more by -38% from June 2021 to August 2022 and there was no recession.

However, the 2021-22 no-recession vibecession was most unusual. Since University of Michigan began reporting consumer vibes in 1952, ICS had fallen by -25% or worse 6 times prior to 2021-2022. Recessions accompanied all 6 prior instances when consumer vibes declined by such a large amount.

If President Trump continues his TACO pattern of threatening extreme tariffs only to soften the terms before actual implementation, consumer vibes may gradually recover as concerns about higher prices subside. A recession with falling incomes and job losses may not happen.

But, it’s also possible that President Trump’s wrong-headed economic policies have already done enough damage to trigger a recession. Signs of weakness in “soft data” on consumer and business confidence may ultimately show up in the form of weaker “hard data” on jobs, incomes and inflation-adjusted demand.

Trump: 6 months ago this country was stone cold dead

The President argued that he revived a “stone cold dead” US economy with his election victory 6 months ago.

The unemployment rate in November 2024 was 4.2% and the inflation rate was 2.7%. As Professor Justin Wolfers repeated throughout the election campaign, the Biden misery index of 6.9 (= inflation + unemployment rates) in November 2024 was the 2nd-best in presidential election months going back over 50 years.

Picking up the misery index torch from Professor Wolfers, I can’t stop repeating that, when Biden left the White House in January 2025, he passed on the best misery index (7.0 = 3% inflation + 4% unemployment) to an incoming president since Truman handed over to Eisenhower in 1953.

Trump was dead wrong to say that Biden left behind a “stone cold dead” economy.

However, I give the President the benefit of my doubt and do not accuse him of deliberately lying. If I may borrow the words of Samuel Clemens (aka Mark Twain), President Trump’s report of the death of the US economy was an exaggeration.

While Trump did earn a Bachelor of Science degree in Economics, he shows no sign of having retained any knowledge of the subject. When President Trump talks nonsense about the US economy, he doesn’t know enough to be consciously lying.

What’s next for US economic data?

Let’s give President Trump credit when it’s due. The misery index for April 2025 was 6.5 = 4.2% unemployment + 2.3% annual inflation, even better than the 7.0 misery index that Trump inherited from Biden in January.

However, Consumer Price Index (CPI) arithmetic may push inflation back toward the “core” rate of 2.8%. Low monthly inflation rates over the last 8 months of 2024 will drop out of the annual inflation calculation over the rest of 2025. The Cleveland Fed is nowcasting that inflation will rise to 2.4% in the next CPI release on June 11th.

US labor market data are notoriously difficult to predict from one month to the next. A small rise in the number of applicants for unemployment insurance benefits is the only sign that we may start to see weaker numbers when the Bureau of Labor Statistics releases its next report on Friday, June 6th.

Even if the May unemployment rate rises above 4.2% in April, we are a long way from the "Sahm rule" recession indicator. Unemployment would have to average 4.6% over 3 months later this year to trigger the Sahm rule.

Trump inherited from Biden steadily growing employment and inflation well down from the 2022 peak rate of 9.1%. Trump’s tariff threats over the first 5 months of 2025 have sapped consumer and business confidence. But, the two highest-profile indicators — inflation and unemployment – show the economy still "marching on ahead". If consumers and business executives catch on to Trump’s TACO game of big talk and little action, perhaps vibes will bounce back before a recession can take hold.

I doubt it. I expect that the damage cannot be undone. TACO or not, a -26% fall in consumer vibes is almost always accompanied by recession.

TACO. TACO. TACO. TACO. TACO. TACO. TACO TACO TACO TACO TACO. TACO. TACO. TACO. TACO. TACO. TACO TACO TACO TACO TACO. TACO. TACO. TACO. TACO. TACO. TACO TACO TACO TACO TACO. TACO. TACO. TACO. TACO. TACO. TACO TACO TACO TACO TACO. TACO. TACO. TACO. TACO. TACO. TACO TACO TACO TACO