Lucky Trump? Best economy for new president in 70 years

Biden hands Trump best misery index for new POTUS since 1953. But, vibes still low.

Source of photo: US Embassy in Montenegro

Quotable quote

Donald Trump campaigning on 2 November 2024:

“economy is like in a depression. The worst numbers I've ever seen. The worst numbers in many, many, many years.”

Hot takes (some even evidence-based)

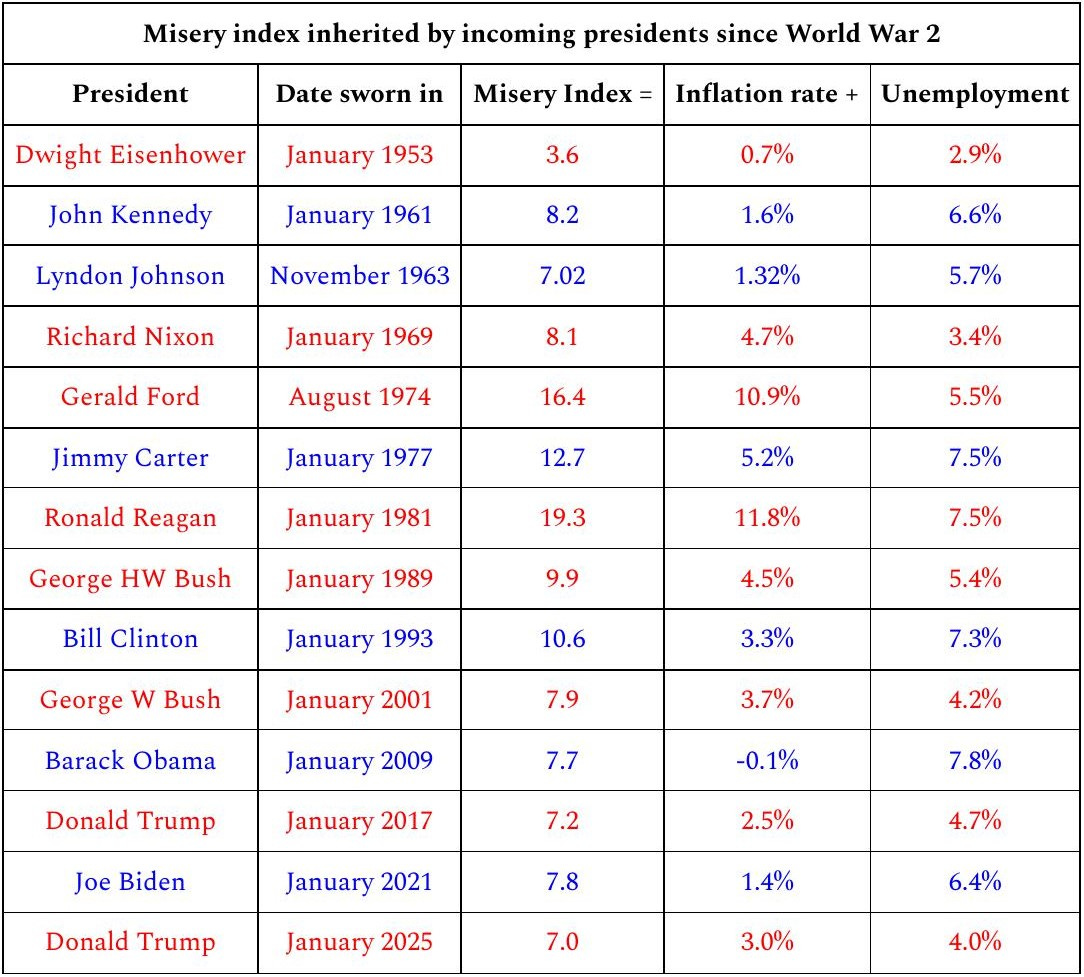

Donald Trump is inheriting the best US economy of any incoming president since Dwight Eisenhower in 1953.

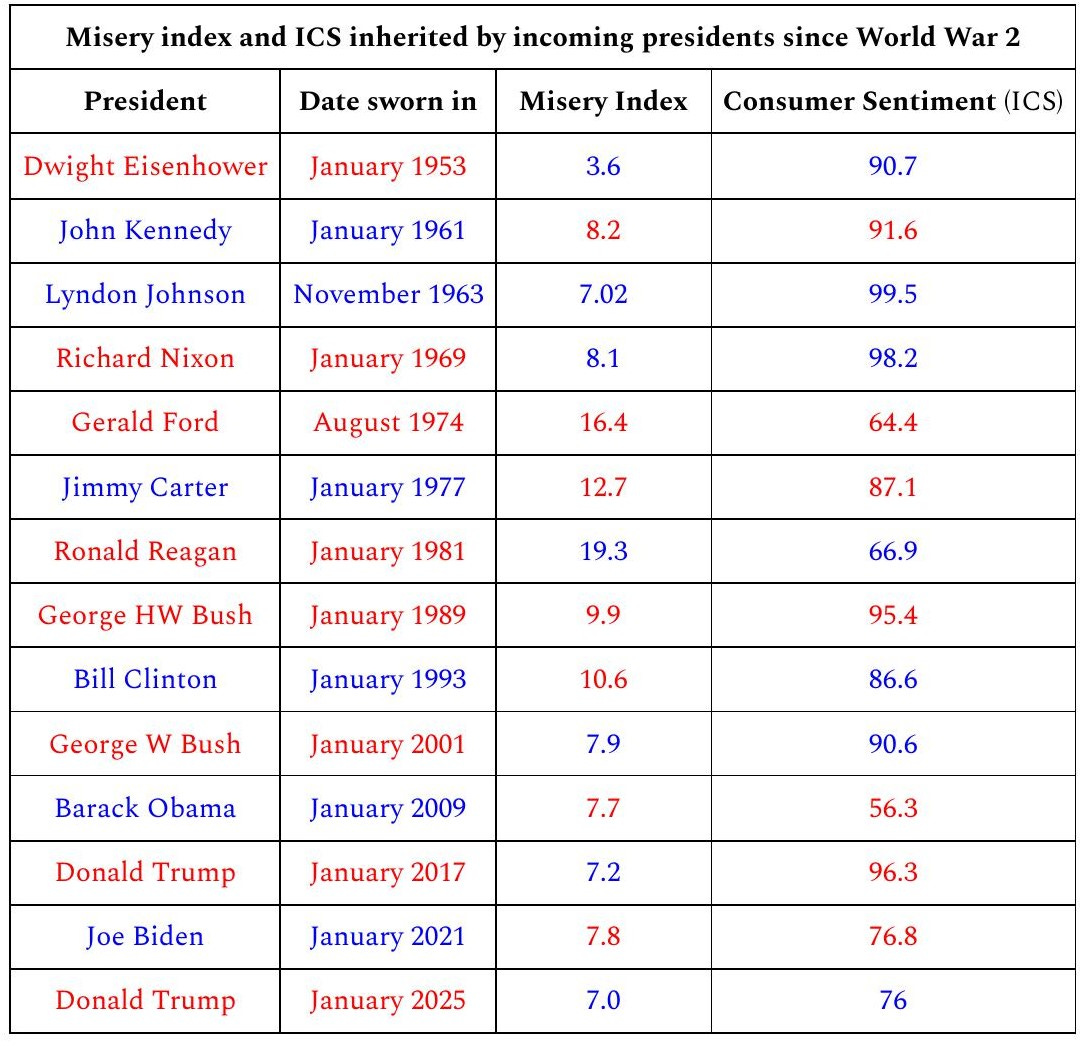

Trump Republicans are inheriting a good economy AND sour economic vibes.

Of the 14 times that the presidency has changed hands since WW2, the misery index is 2nd-best, but economic vibes are at the 4th-lowest level.

Trump will trumpet good inflation news below 3% in the next 2 CPI releases.

Trump’s communications team may seize on news of lower inflation to argue that Trump’s tariffs do not affect US prices.

Good inflation news may boost consumer sentiment temporarily this spring.

But, annual inflation may bounce back toward 3% later in 2025.

More often than not, the party holding the White House needs good economic vibes as measured by consumer sentiment to win the next election.

IF elections remain free and fair, the Republican nominee will win in 2028 only if President Trump keeps the US economy humming along with inflation and unemployment under control.

What are the chances that a demented Trump will be a good economic manager?

Economic misery index still looking good

Top economist Justin Wolfers fought a losing battle all the way to the 2024 election trying to convince twitterverse denizens that the US economy was in good shape. Wolfers relied on the misery index – the simple calculation adding together the inflation and unemployment rates, the 2 most important economic indicators.

Professor Wolfers couldn’t change enough minds. Most Americans voted based on what their hearts were telling them – that the Biden-Harris economy had been bad.

Americans may not have agreed with Trump’s assessment that the economy was “in a depression”, but most voters felt rather depressed about the economy. President Biden left office with 59.5% of Americans disapproving of his economic record. Consumer sentiment just before the election was at a below-average level where past administrations had been voted out of office decisively. Vice President Kamala Harris did well to lose by only 1.5 percentage points in the national popular vote when voters were feeling so sour about the economy.

Only diehard Democrats paid any attention to Wolfers’ accurate reminder that the economy was at the 2nd-best “level for any presidential election cycle in 50 years” as measured by adding inflation to unemployment before the election.

It’s likely no consolation for Professor Wolfers or Biden-Harris Democrats. But, if we measure the misery index in the month when the office changes hands, we would have to go back over 70 years to Republican Dwight Eisenhower in January 1953 to find an incoming president taking over a better economy than what Trump just inherited.

Source: St. Louis Fed https://fred.stlouisfed.org/graph/?g=IenV

Note: The St. Louis Fed calculates the misery index = inflation + unemployment with both rates seasonally-adjusted. If we use the annual inflation rate not seasonally adjusted, there are times when we get a slightly different misery index. For example, annual inflation peaked during Biden’s term at 9.1% in June 2022 with the CPI not seasonally adjusted and at 9.0% seasonally adjusted. I must confess that I do not understand how the annual rate of inflation = rate of change in CPI over 12 months can differ on a seasonally adjusted vs. unadjusted basis. This issue affects neither January 2025 nor November 1963 nor January 2017. Thus, my conclusion is not affected. Biden handed Trump the lowest misery index for any transition since 1953.

Perhaps I’m stretching my point by taking the misery index to two decimal places. But, even at just one decimal point, we would have to go back over 60 years to Lyndon Johnson being sworn in after President Kennedy’s murder in November 1963 to find a new president taking over an economy even matching the benign state of affairs that Biden handed over to Trump.

Americans still feel pretty miserable about the economy

What’s important is NOT the quirk of numbers behind my finding that the Biden economy was the best since 1953, not 2nd best as Professor Wolfers reported. It just so happens that the Biden-Harris economic legacy moved ahead of Obama’s when we measure the misery index in the inauguration month of January instead of the November election month that Professor Wolfers used in his chart.

What’s important is that the Trump Republicans have inherited both good economic numbers AND the low economic vibes that defeated Kamala Harris.

You can stop reading this post, if you think that:

• The 2028 presidential election will NOT be free and fair.

• MAGA will rule forever starting possibly with Trump as President-for-life.

But, keep calm and carry on reading, if you think that:

• There is at least some chance that the 2028 election will be free and fair.

• It’s never too soon to start thinking about the next presidential election.

This was the 14th time that the presidency changed hands since the end of World War 2. Trump inherited both the 2nd-best misery index AND the 4th-most miserable economic vibes as measured by the Index of Consumer Sentiment (ICS).

Source: University of Michigan ICS and same as previous table for misery index.

Notes: ICS reported for February after January inaugurations. February is a good month to set as the starting point for the economic vibes impacted by economic news during a new president’s term. Any post-election “honeymoon” effect is usually over by February. Media coverage of January economic data, the last month for which the outgoing president can be held responsible, affects consumer sentiment in February.

February 2025 ICS adjusted to be comparable with readings prior to April 2024 change in survey methodology.

Economic vibes and the 2028 election

The political impact of economic vibes will belong to the Republican presidential nominee in 2028. Donald Trump could be that candidate if the Supreme Court agrees with Steve Bannon that a loophole in the 22nd amendment allows Trump to run again. Whether the Republicans’ 2028 nominee is President Trump, Vice President Vance or someone else, the Republicans will win a free and fair election only if economic vibes perk up a bit by November 2028.

Economic vibes do not move independently of how the economy is doing as measured by economic data. If Trump keeps the economy humming along with inflation and unemployment under control, Americans will start to feel better economic vibes.

Even if the Donald himself cannot run again, the Republican nominee will bask in reflected glory if the economy remains strong. For example, Vice President George Bush was elected President easily in 1988 because most Americans were happy with the economy after 8 years of much lower inflation under Ronald Reagan.

Conversely, the Republican nominee in 2028 will not escape bad voter vibes if the economy turns bad due to bad management by Trump or even just bad luck. For example, Vice President Kamala Harris lost the 2024 election because most voters were still unhappy with the high prices left over by high inflation in 2021 and 2022 and blamed the Biden-Harris administration.

In this century, neither the misery index nor any other piece of economic data on election day has been a perfect indicator of who will win the presidency. However, you could have used economic vibes as measured by the ICS to predict the winner of the national popular vote in 15 of the last 19 presidential elections including the past 2 in 2020 and 2024.

If the 2028 election is free and fair, the Republican nominee will NOT win unless economic vibes rise by at least 10% or so. No party in power has kept the White House with economic vibes lower than ICS = 82.6 when Obama won re-election in 2012.

Inflation and economic vibes

With Donald Trump back in the White House and unemployment much lower than it was 4 years ago, Americans are not feeling any better about the economy today than when Joe Biden took charge in 2021.

Is that because inflation at the end of the Biden presidency was worse than when Trump ended his 1st term? That’s too simple an explanation for why economic vibes have remained below-average for so long.

When Biden took office, vibes had recovered after the 2020 covid recession lows, but were still relatively depressed. What we don’t see in the 2nd table is the relatively high misery index of 12.7 in June 2022 when post-covid inflation peaked at 9.1%.

There was no recession during Biden’s presidency. Nevertheless, consumer sentiment plunged to an all-time low of 53.2 (3-month average) in August 2022. Kyla Scanlon called it the vibecession. I say that the 2021-2022 vibecession was inflation-induced.

Economic vibes recovered as inflation subsided from the summer 2022 peak. But, consumer sentiment remained below-average. The fall in the annual inflation rate did not cure the lingering public discontent over the high prices that remained in place.

After the election, Trump told NBC News:

“I won on groceries…the price … We’re going to bring those prices way down.”

Inflation outlook

Occasionally, Trump knows how to practice good politics. Trump’s response to news last week that annual inflation rose to 3% in January 2025 from 2.9% in December:

“BIDEN INFLATION UP!”

Trump was quite correct. The Donald was not to blame. Biden was president from January 2024 to January 2025 when prices rose by 3% on average.

There will be good inflation news over the next two months as high monthly inflation readings for February and March 2024 drop out of the annual calculation. In the next two inflation updates, the annual rate will fall below 3% as long as monthly inflation is 0.5% or lower. In other words, as long as the annualized rate is 6% or lower in the next 2 monthly updates, the annual inflation rate will fall below 3%. Thanks to left-digit bias, a fall in annual inflation from 3% to 2.8% -- the Cleveland Fed’s latest "nowcast" for the next release -- may be perceived as almost as large as a fall from 3.0% to 2.0%.

When the Bureau of Labor Statistics announces this good inflation news on March 12, cue the trumpets. President Trump will be loud and proud claiming credit. Team Trump may even exploit the upcoming good inflation news to argue that Elon Musk deserves credit - that inflation fell because federal government workers were fired. Most members of the public and even some business reporters may not understand that falling annual inflation in the CPI releases for February and March will be due to the simple arithmetic of high inflation in early 2024 dropping out of the calculation.

News of lower inflation may boost economic vibes this spring. But, what goes around comes around in the inflation calculation. Annualized inflation averaged 1% from April 2024 to year-end. As those low monthly price hikes drop out of the calculation, annual inflation may tick up later this year. If inflation bounces back to 3% or higher, President Trump will not be able to blame Biden. Any springtime revival in consumer sentiment may wither on the vine.

The Fed decides

Ultimately, the Republican Party’s fate in a free and fair 2028 election may depend on the next Chair of the Federal Reserve. President Trump has already announced his plan to replace current Fed Chair Jerome Powell, when his term expires in 2026.

Choosing the Fed Chair — the most powerful economic post in the US government — will be the most consequential economic policy decision of Trump’s 2nd term. If Trump nominates a dangerous ignoramus like his picks for other important posts – Director of National Intelligence Gabbard, Defense Secretary Hegseth, Health Secretary RFK Jr., FBI Director Patel, the Republican nominee in 2028 will be doomed.

What about unemployment and consumer sentiment?

Americans do not care as much about high unemployment as high inflation. But, voters do care about high unemployment in an election year, as President Bush the elder discovered to his sorrow when he lost so badly in 1992.

There is some chance that the unemployment rate may fall below the current level of 4% in the next labor data release on March 7. If so, President Trump will trumpet the good news. Left-digit bias will result in any fall from 4.0% to 3.9% feeling much better than the recent decline from 4.1% to 4.0%.

Even if the unemployment rate rises at some point, left-digit bias may dampen the effect on public perceptions of the economy until unemployment rises to 5% or more. There’s no science behind my opinion, but I could imagine a scenario with the unemployment rate as high as 4.9% at the time of the 2028 election with economic vibes higher than they are now as long as inflation remains under control.

So, a Republican win in 2028 is certainly plausible. Were I a Republican, I would have one concern. Jeff Bezos reported that Trump seems “calmer … more confident, more settled” returning to the White House at age 78 than when he left the presidency at 74. I’m no doctor, but Trump appears demented to me. If President Trump is still making economic policy decisions at age 82 in 2028, that will not bode well for inflation, unemployment, economic vibes or the Republican nominee’s election chances.

A note on the misery index

Arthur Okun devised the misery index more than 50 years ago. The misery index is often useful as “a quick-and-dirty measure of the state of the economy”. (Krugman)

Okun never claimed that his invention would be the one economic data point to rule them all. Indeed, there can be times when the misery index is too “quick and dirty” and sends a misleading signal.

For example, the January 2009 misery index of 7.7 looks not too bad in the 1st table near the start of this post. Just looking at the misery index for January 2009 would not tell you that the economy had tumbled into a severe recession triggered by a financial sector crash.

The US economy was in a terrible state in January 2009. The unemployment rate had risen in just 9 months to 7.8% from 5%. Unemployment would keep rising to peak at 10% in late 2009. Annual inflation in January 2009 of -0.1% -- price deflation or falling prices on average – was a symptom of a sick economy. Deflation would hit bottom at -2.1% in July 2009.

You cannot judge the state of the economy based solely on the misery index in a single month. You have to look at the path of the misery index over time. And, you have to be particularly careful interpreting the misery index when prices are falling. Deflation makes consumers happy and makes the misery index look good, but is normally a very bad sign for the economic outlook.

A wild card in all this is whether Trump decides to follow through with his threats to use tariffs to restructure the North American automobile industry. The resulting unemployment, which would be concentrated in certain states, and the effects on auto prices and supply would worsen Republican chances of holding the House in the midterms. Will that stop him going down that path?