Will Trumpcession mar USA’s 250th year?

Labor data say US economy still strong. Consumer vibes still low in recession zone.

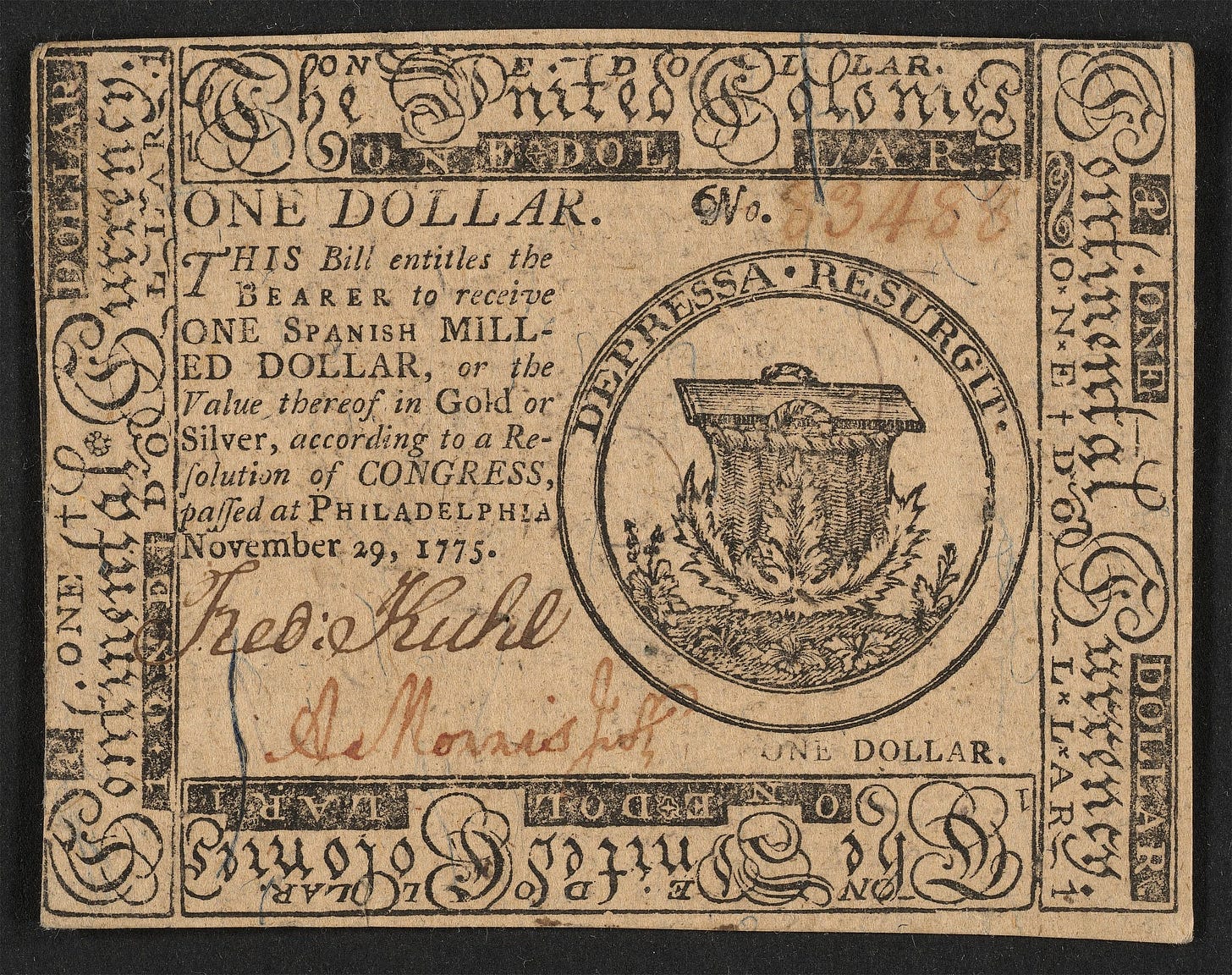

Source: 1st US$ issued by Continental Congress in 1775.

Source: https://id.lib.harvard.edu/curiosity/american-currency/66-W363045_urn-3:HBS.Baker.AC:1083766

10 hot takeaways

3 views of the US economy are plausible: great, OK, recession.

Dueling forecasts are an intramural cage match between Harvard Professor Summers, who warns of recession v. Harvard PhD and Trump economist Miran, who foresees great growth.

The labor data remain consistent with the US economy being in solid shape. Unemployment is well below the “Sahm rule” level warning of recession.

Despite good inflation and jobs data, consumer vibes fell from January to May at a steep rate consistent with past recessions. But, vibes rebounded a bit in June.

The annual inflation rate will turn back up toward 3% over the rest of 2025.

If Trump implements his tariff threats, the inflation picture will get even worse.

Higher inflation will put an end to Trump boasting "NO INFLATiON".

Vibes will fall back into the recession zone as annual inflation ticks up. Americans’ top financial concern remains inflation.

I expect a US recession based on the simple decision criterion that Summers is a more credible economist than Miran.

If there is a recession, President Trump will be the culprit because his trade policy threats and actions undermined consumer and business confidence.

Happy belated birthday, USA economy

It’s been 249 years since the Declaration of Independence was signed on the 4th of July 1776. I’m no economic historian, but I take the liberty of making 3 points:

Americans were already the richest people in the world in 1776. Income per person was higher in the 13 colonies than in Great Britain. (Source: Alice Hansen Jones. Yes, I know that this point is debatable for many reasons.)

After British forces surrendered at Yorktown in 1781, America’s first years of independence were marred by 4 economic recessions by 1796. The 1780s were as bad for the US economy as the 1930s Depression.

The bad post-independence economy encouraged representatives of the 13 states to agree on the 1787 Constitution forming a federal government.

(Real historians, feel free to correct or modify my takes by going to the comments section.)

249 years later, the USA still has the best economy in the world even after living through 48 economic recessions over that history.

Will a 49th recession start in this 250th year since America’s Declaration of Independence? According to the simplest possible calculation of the odds, there is a 20% chance of a recession starting before next July 4th. About 1-in-5 of the past 249 years has been marked by the start of an economic downturn.

Is the US economy great, bad or OK in 2025?

Economic commentators are in 3 broad camps about the state of the economy:

“astounding economic growth in the president’s first term, 2.8 percent until the pandemic. And that’s exactly what we forecast again, very similar numbers.” (President’s Council of Economic Advisers Chair Stephen Miran)

“more risk … of recession, more stagflation, that’s the risk facing every middle-class family in our country” (Larry Summers)

“it won’t be surprising if the economy remains … okay” (James Surowiecki)

Think of the Miran v. Summers dispute as an intramural Harvard cage match. Harvard Professor Summers mocked Miran’s forecast as “nonsense”. Dr. Miran (PhD, Harvard) dissed Professor Summers’ warning as “doom-mongering”.

Labor data OK with no sign of recession

The unemployment rate over the last 3 months averaged 4.17% – up only slightly from 4.0% one year ago. That small increase amounts to only ⅓ of the rise needed to trip the “Sahm rule” recession warning. The June payroll report showed another solid increase in job numbers. Miran touted the report as “proving that the haters and doomsayers don’t know what they’re talking about.”

Consumer vibes update

I’m a doomsayer by nature. I can’t stop warning that consumer vibes as measured by the Index of Consumer Sentiment (ICS) pointed to recession in May 2025 when the 3-month ICS average came in -26% below the January level. Such a steep fall in vibes is not a sure sign of recession, but has been correlated with past recessions. 6 of 7 prior instances when vibes fell -25% or more were followed by or coincided with recessions.

The first 6 months of 2025 have been the most volatile period for consumer vibes (ICS) since the half-year after the Arab oil embargo started in the autumn of 1973.

Monthly ICS plunged by 29% over 4 months from end-2024 to April 2025 despite good news this winter about falling inflation.

Vibes stabilized in May remaining at the low level of April.

And then vibes jumped up 16% in June 2025, the 3rd-best monthly increase in the 47 years that University of Michigan has been reporting ICS on a monthly basis.

What does this wild vibes ride mean? Let’s start by going straight to the source quoting Surveys of Consumers Director Joanne Hsu:

“Consumer sentiment … remains well below the post-election bounce seen in December 2024… Despite June’s gains, however, sentiment remains about 18% below December 2024, right after the election; consumer views are still broadly consistent with an economic slowdown …, but at this time they do not appear to be connecting developments in the Middle East with the economy... Consumers’ fears about the potential impact of tariffs on future inflation softened somewhat in June. Still, inflation expectations remain above readings seen throughout the second half of 2024, reflecting widespread beliefs that risks to inflation have not fully abated.”

Why are vibes low when the economic numbers are good?

I have an explanation (admittedly an unproven theory) for why Americans have been mired in economic gloom for the past 4 years. My intuition is that feelings about the economy have been determined almost entirely by concerns about high prices since inflation surged in the spring of 2021.

Consider the sequence:

Annual inflation rose from 1.4% in January 2021, when Biden took office, to peak at 9.1% in June 2022. Consumer vibes fell -38% from mid-2021 to August 2022.

Inflation then fell fairly consistently to 2.4% by September 2024 – the final data release before the November election. Vibes rebounded 46% to October 2024, but did not get back to the 2021 high before inflation took hold. Voters blamed the incumbent Democrats for inflation and high prices. Trump beat Kamala Harris.

Since the November election, inflation has not changed much, but vibes have bounced up, way down, and now back up a bit. During Trump’s post-election honeymoon to December, most Americans were optimistic that the new president would lower inflation and bring better times. Back in office, Trump’s tariff threats sparked fears of higher prices. Vibes crashed through April. Americans then caught on that Trump’s mad dog bark is often worse than his bite. If the President starts to get scared that he will tank the economy, TACO = Trump Always Chickens Out as Robert Armstrong tweeted. Consumer vibes stabilized in May and rebounded 16% in June as consumers’ tariff and inflation fears subsided a bit.

All the vibe volatility since the November election was divorced from actual news about economic data. Inflation and unemployment moved up and down a bit, as is often the case when the economy is doing well. But, there has been no dramatic news from economic data that could explain the ups and downs of consumer sentiment.

Inflation news will get worse

The bloom is about to fade from the rosy inflation picture that President Trump enjoyed this spring. Annual inflation dropped from 3.0% when Trump returned to the White House in January to 2.3% in April. That decline was not the President’s doing. Rather, inflation fell due to 2 forces not Trump-related:

Arithmetic – relatively high monthly inflation rates from February to April 2024 dropped out of the annual calculation and were replaced by lower rates in the same months of 2025.

Gasoline prices dropped 7% from January to April as the world price of oil fell. No president controls oil and gasoline prices, contrary to popular belief.

Trump boasted about inflation falling from January to April, as any president would. But, these formerly favorable inflation forces are turning against President Trump.

Inflation over the last 7 months of 2024 ran below a 1% annualized rate. It’s unlikely that those low monthly inflation numbers of the last half of 2024 will recur over the rest of 2025. As low monthly inflation rates in 2024 fall out of the annual calculation, the annual inflation rate reported in news headlines will rise. The Cleveland Fed is “nowcasting” that the annual rate will rise from the current 2.4% to 2.6% when the Bureau of Labor Statistics (BLS) releases the June estimate on July 15th.

Gasoline prices stopped falling, rose and have since stabilized at a slightly higher level after Israel and the US attacked Iran. There is no gasoline price relief in sight for the Trump Administration unless America’s Arab allies turn on the oil taps or there is a worldwide economic slowdown.

Even before considering the impact on prices of Trump’s tariffs including his latest threat of 25% tariffs on Japanese and Korean goods, annual inflation is on course over the rest of 2025 to drift back toward the “core” rate or underlying trend of about 3%. That would be no higher than the inflation rate that Trump inherited. But, even a small inflation uptick would pose a public relations problem for President Trump, who has been bragging about "NO INFLATiON".

Has a recession already started?

There is no evidence yet that a recession is under way.

I have received some skeptical pushback from those who point to the Bureau of Economic Analysis (BEA) report that real Gross Domestic Product (GDP) fell in the first 3 months of 2025 at an annual rate of -0.5% after adjusting for inflation.

It’s true that recessions always include real GDP declines. But, there’s more to the definition of an economic recession than just one quarter of falling real GDP.

For example, consider the US economy in 2022. Real GDP fell at an annualized rate of -1% in the 1st quarter of 2022 and rose only 0.3% in the 2nd quarter. Real GDP was a bit lower in mid-2022 than at the start of that year. But, the number of jobs kept rising throughout 2022 as the economy continued to recover from the 2020 covid recession and health-related lockdowns. The National Bureau of Economic Research (NBER) never issued a recession call.

Kyla Scanlon made her name calling this episode a “vibecession”. Consumer vibes fell -38% from mid-2021 to August 2022 with no economic recession. This period illustrates my point – while real GDP declines are a feature of all recessions, not all real GDP declines trigger a recession call by the NBER.

In addition, I’m not convinced that updated estimates will show that real GDP actually fell in the 1st quarter of 2025. Ben Casselman of the New York Times pointed out a possible mismatch in the survey data used to estimate real GDP. The surge in imports as wholesalers and retailers raced to get ahead of expected tariffs may not have been matched correctly by a large enough offsetting rise in business inventory investment. The inventory survey may not catch up to big changes as fast as the import survey.

Similar problems may muddy the picture when the BEA releases on July 30 the 1st estimate of real GDP for the 2nd quarter of 2025. Real GDP estimates may not provide a clear picture of what is really going on in the US economy until the Trump tariffs are fully in place in the 2nd half of 2025.

Bottom line: even if I am right that America’s 250 year includes a recession, and Dr. Miran is wrong, the start will not be post-dated back to the first half of 2025 when all the economic data are in and NBER experts provide a ruling. Of course, if there’s never any NBER comment about a recession in 2025 or 2026, that would effectively constitute a NBER ruling that I was wrong and Dr. Miran was right.

I do have to quibble with the statement: "Higher inflation will put an end to Trump boasting "NO INFLATiON"." He can still boast about it, but the boast will be a lie like so much of what he says about individual items like gasoline (allegedly below two dollars per gallon somewhere, although no one can find that place) and eggs (allegedly down 40% in one account and 400% [?!?!] in another).