Will Mideast war tip US into recession?

Gasoline price spike could be last straw that breaks economic camel’s back.

Iranian oil depot on fire after Israeli strike. Source: youtube.com

Hot takes

The Israel v. Iran war increases the probability of a US recession.

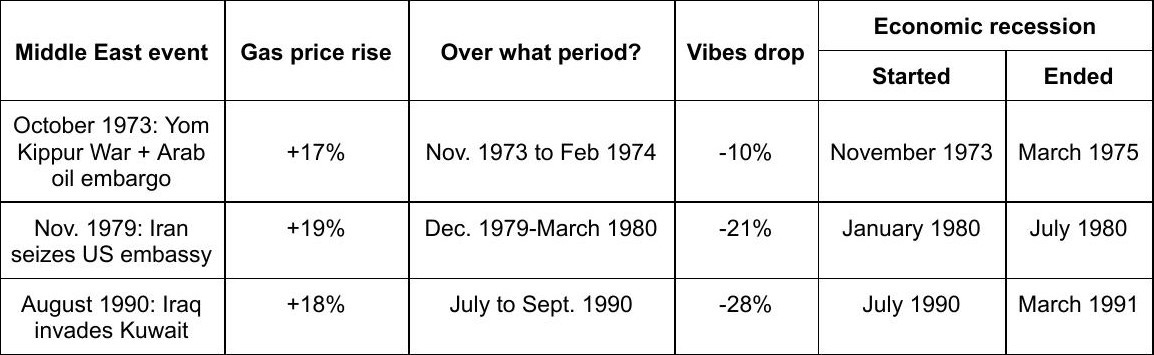

Mideast turmoil helped push the economy into 1973, 1980, 1990 recessions.

In each case, the US economy was already weakening. Mideast turmoil then caused oil prices to rise. Gasoline prices rose 17% or more in 3 months followed by consumer vibes falling -10% or more. Recessions ensued.

Will 2025 be “déjà vu all over again”?

Rule-of-thumb: $10/barrel rise in price of oil = $0.25 rise in gasoline price at pump.

Gas prices are rising just as consumer vibes were starting to rebound.

Upcoming Index of Consumer Sentiment readings (June 27th, July 18th) will tell us whether rising gasoline prices have nipped the vibe rebound in the bud.

Will 2025 rhyme with recessions of 1973, 1980 and 1990?

History shows that a 4-step process can end in a US recession.

Turmoil in the Middle East. Oil price number go up.

Oil price number go up. Gas station number go up.

Gas price number go up. Consumer vibe number go down.

Vibe number go down. Real income, job numbers go down.

Sources: Consumer Price Index (CPI) Gasoline, Index of Consumer Sentiment (ICS) for vibes, National Bureau of Economic Research (NBER) for recessions.

Note: Vibe drops reported for period lagged by one month — e.g., -10% drop in ICS from December 1973 to March 1974.

Theodor Reik wrote in 1965:

“It has been said that history repeats itself. This is perhaps not quite correct; it merely rhymes.”

2025 may rhyme with Mideast-triggered recessions past. The Israel v. Iran war increases the probability of a US recession, but not to 100%. It remains possible that this year for the US economy may turn out to be just a no-recession vibecession. In that case, 2025 will rhyme with the 2021-22 vibecession.

Low gas prices best economic story of Trump 2.0

Overall inflation declined from 3% in January to 2.4% in May. Gasoline prices as measured in the CPI were down almost 10% over that period. Lower gas prices accounted for one-third of the fall in annual inflation since Trump returned to power.

What’s next for gasoline prices? Number go up with oil

The national-average gas price had settled in a range just above $3/gallon before Israel attacked Iran on Friday the 13th of June.

The price of oil (as of 14:30 EDT on the 17th) is up over $9/barrel or about 15% over the past week. The price started creeping up with rumors that Israel was preparing to attack. When Israel did so on Friday the 13th, the oil price jumped 7% that day.

Oil accounts for over half of the pump price of gasoline. The rule-of-thumb:

“a $10 rise in the price of a barrel of oil is correlated with an approximately 25-cent increase in the price of a gallon of gasoline”

US gas prices won’t adjust in full this week or even next week. Some gas stations are still selling from existing inventories purchased before the oil price spike. But, gas prices start rising “within the first week of an anticipated increase … in oil prices”, according to St. Louis Fed researchers. The national-average price today June 17th is up to $3.17/gallon from $3.13/gallon before Israel attacked.

Gas prices will adjust fully to the oil price spike over the coming weeks, but only IF higher oil prices are perceived to be lasting. Even if the oil price does no more than stay in the current range just above $70/barrel, prices should ultimately rise at least another $0.15/gallon to push the national-average price of regular gas above $3.30.

Gas prices up. Vibes down.

Gasoline accounts for less than 3% of the average consumer’s budget. Yet, gas prices are often the tail that wags the dog when it comes to consumer vibes. I can’t do better than quote Professors Makridis (MIT) and Binder (Haverford, alma mater of Commerce Secretary Lutnick) from their 2022 study.

“Consumers may rely on the prices they view and interact with most frequently as a signal of the state of the economy. Local gas prices are highly visible even among consumers who do not regularly purchase gas (e.g., given media coverage) ... consumers who observe higher gas prices expect higher inflation … this translates into worse economic sentiment.”

Thanks to left-digit bias, drivers will perceive a gas price increase as particularly bad in states where the gas price had been just under $3/gallon. For example, the Florida-wide average price of gas rose from $2.95/gallon on June 16th to $3.09 today the 17th. Some drivers may perceive a gas price hike that crosses the $3 barrier as worse than a past price rise from $2.80 to $2.95. The average gas price just crossed the $3 threshold in other states – Delaware, Minnesota, Wisconsin – and is close in the Dakotas, Nebraska, New Hampshire.

Gas prices rising just when vibes were perking up

One factor that made oil price hikes in 1973, 1979-80 and 1990 particularly damaging to the US economy was that consumer vibes were already slipping in each case. Mideast turmoil struck and tipped an already weak US economy into recession.

There’s some hope that the US economy may be a bit more resilient in June 2025. Last week, University of Michigan reported that the preliminary reading of the June Index of Consumer Sentiment (ICS) was up 16% from May. June is the first month this year to see consumer vibes rise.

Despite the June rebound, consumer vibes remain depressed well below the long-run average. June ICS remains down -16% since President Trump took charge in January.

The 3-month average ICS measure that I use in my vibecession test still shows the US economy in vibecession. Using 3-month averages, vibes are down -24% since January. That’s better than down -26% last month, but still beyond my -20% Scanlon-Sayeed threshold for declaring a vibecession.

We may well see the final ICS reading for June come in lower than the preliminary number, thanks to rising gasoline prices since the preliminary survey in early June.

Just a vibecession or will it be a recession?

The decline in consumer vibes from January to May 2025 was the 8th time ICS has fallen -25% or worse since the University of Michigan began measuring consumer sentiment in 1952. Economic recessions accompanied 6 of the 7 previous instances.

The vibe rebound in the preliminary ICS number for June does strengthen the case that 2025 could turn out to be a year of no-recession vibecession. (See Dr. Miran.)

However, rising prices for oil and gasoline in the wake of war in the Middle East threaten to transform that relatively rosy vibecession scenario into a replay of the 1973-75, 1980 and 1990-91 recessions.

I do not pretend to know much about military matters. I do know that there are plausible scenarios in which the war ends soon and oil prices fall back. Indeed, the oil price hike so far may not be large enough to send gas prices so high that consumer vibes will crash the way they did in a past case like 1990. But, there are other scenarios in which oil and gasoline prices spike even higher and stay high.

Let’s see what the final June ICS number looks like on the 27th. In the meantime, keep a close eye on the price of oil and the price at your local gas station. If your gas gauge is low, today might be a better day to fill up than tomorrow.