Sahm rule: US economy NOT in recession -- yet

Reports NOT correct that June unemployment rise to 4.1% triggered recession signal.

Evidence-based takes

Recent reports were wrong that the rise in unemployment to 4.1% in June triggered the Sahm rule indicator that the US economy is in recession.

Recession chicken littles forgot that, in both components of Claudia Sahm’s formula, the unemployment rate is averaged over 3 months.

Unemployment has not triggered the Sahm rule yet, but the rate is close to the threshold signaling recession.

Another unemployment rate increase next month would trip the Sahm rule, thereby generating negative headlines about recession just as the Democrats prepare for their national convention.

American Institute for Economic Research got it wrong

In AIER’s own words, when June labor data were released on Friday:

“In this morning’s US Bureau of Labor Statistics [BLS] data release, the U-3 unemployment rate increased 4.1 percent in June 2024, rising by one-tenth of a percentage point … This uptick triggers the Sahm Rule, a real-time recession indicator, suggesting that the US economy is in, or is nearing, a recession. The Sahm Rule, developed by former Fed economist Claudia Sahm, is designed to identify the start of a recession using changes in the total unemployment rate. According to the rule, a recession is underway if the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more, relative to its low during the previous 12 months. With the June 2024 U-3 rate of 4.1 percent, the average of the last three months being 4.0 and the lowest 12-month rate of 3.5 percent in July 2023, this criterion has been met.”

Peter St. Onge of the Heritage Foundation tweeted a similar claim.

“Unemployment jumps to four-year high, triggering the Fed’s dreaded Sahm Rule that says we are already in recession.”

(Postscript 2024-9-22: Dr. St. Onge receives special mention as a contributor to Chapter 24, “Federal Reserve” in Mandate for Leadership: The Conservative Promise issued by the 2025 Presidential Transition Project — aka Project 2025.)

Who’s right? AIER and St. Onge or St. Louis Fed?

After the BLS release, MarketWatch.com checked with Jason Furman: “Sahm rule that predicts recessions is not triggered, Furman says”.

Of course, many Americans might not accept Furman’s word. He is a Harvard Professor, served as Chair of President Obama’s Council of Economic Advisers and generally supports the Democratic Party.

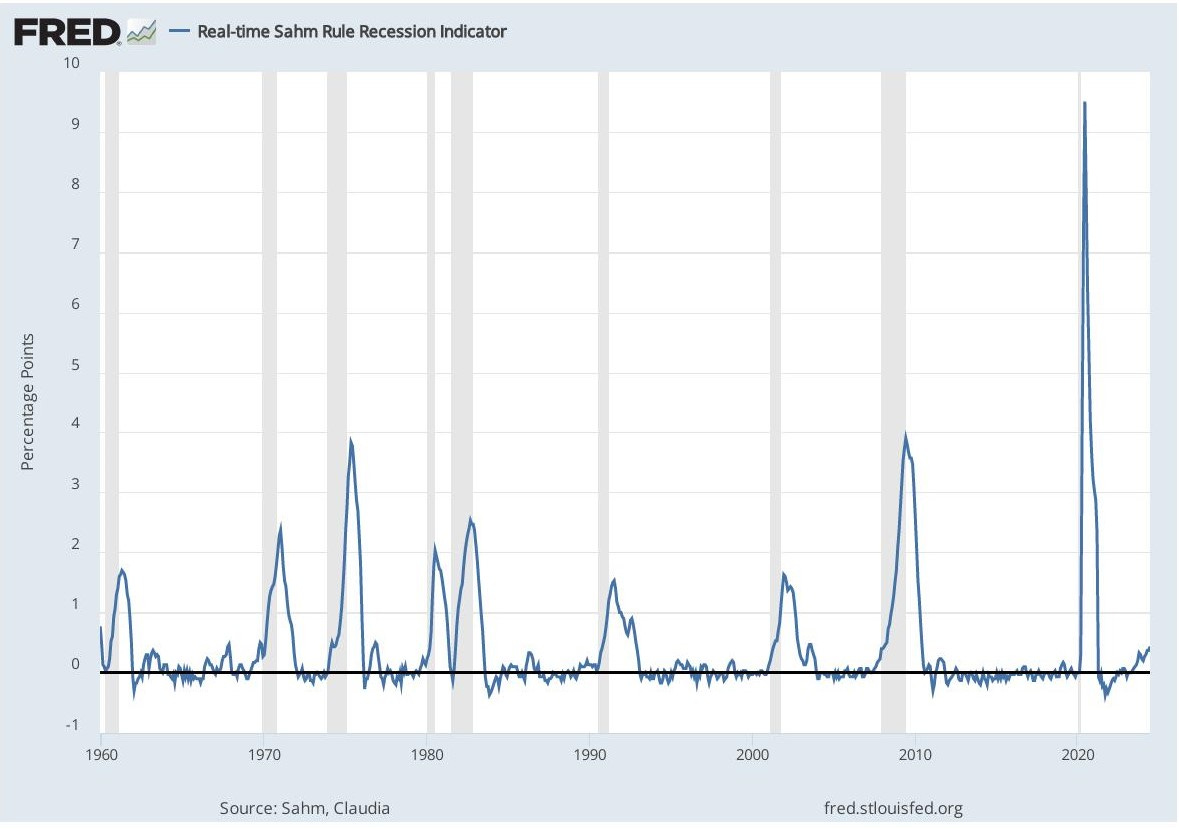

However, the statisticians at the Federal Reserve Board of St. Louis updated their Sahm rule chart and confirmed that the Sahm indicator is now at +0.43 points, below the 0.5 threshold indicating recession. There is no evidence that politics influences how the St. Louis Fed presents data.

Where did AIER go wrong?

On their website, St. Louis Fed researchers define the Sahm rule:

“Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.”

AIER researchers compared the latest 3-month average of the unemployment rate, 4%, with the lowest monthly unemployment rate over the past year – 3.5% in July 2023. To apply the Sahm rule correctly, AIER should have used the lowest 3-month average for the unemployment rate over the past year – 3.57% in July 2023.

AIER researchers made the mistake of comparing apples-to-oranges in their data analysis. Another way of describing what went wrong is that AIER compared the latest 3-apple-average to a single apple.

Why does Sahm use 3-month averages in her rule?

It’s worth taking the time to read Claudia Sahm’s guide: “The Sahm rule: step by step”.

“Smooth out the monthly ‘bumps and wiggles.’ It is important to never overreact to the latest numbers about the economy, regardless of what data series we’re talking about. Being data-driven is good, but being data-ridden is not.”

Also, see the explanation by Jared Bernstein, Chair of President Biden’s Council of Economic Advisers, for why the 3-month average is a better measure of labor market trends than just the latest month.

“Because monthly data tend to be somewhat “noisy,” we at the CEA find it useful to look not just at the monthly number, but at the three-month moving average. This procedure helps us separate the signal, or more persistent trend, in the data from the monthly noise.”

By citing Bernstein, I am referring to another economist who supports the Democratic Party. But, there is no evidence that 3-month averages favor the Democratic Party while monthly data tilt Republican.

Is a US recession coming?

AIER researchers and Dr. St. Onge got out in front of their skis calling a recession.

But, it is true that the unemployment rate is now close to the Sahm rule threshold. The 4.1% rate for June marked the 3rd consecutive month that the seasonally-adjusted unemployment rate rose by 0.1 percentage points. BLS will report the July unemployment rate on August 2. If the rate rises again, the Sahm rule will trigger.

Claudia Sahm herself cautions that:

“even if it does trigger, a recession is not a done deal. The Sahm rule is a historical pattern, and this time could easily be different.”

Nevertheless, as the Democratic Party prepares for its national convention in August, the month may start with headlines that the economy has fallen into recession.